Defined Benefit and Hybrid Plans

As a defined benefit retiree, you will receive a Form 1099-R issued by MERS.

- Forms will be mailed by January 31, 2024, and can also be retrieved in your myMERS account once they have been issued.

In some circumstances, you will receive more than one 1099-R:

- If you are receiving a benefit from multiple employers, you will receive a 1099-R for each.

- If you reached age 59½ in 2023, you will receive one Form 1099-R for the benefits you received before that date and one for the benefits your received after that date, to comply with IRS coding requirements.

- If you have a Hybrid Plan or you also have a MERS Defined Contribution Plan, 457 Program or IRA with MERS, you will receive a separate Form 1099-R issued by Alerus Retirement and Benefits for each account that you took a distribution from. (Learn more about these 1099-Rs in the section below.)

To retrieve the 1099-R for your Defined Benefit Plan (including the defined benefit portion of a Hybrid Plan), log in to your myMERS account at mersofmich.com and select “DB Monthly Pension” from the “Accounts” section on the left side. (If you have added outside account information to the Financial Fitness tool, you will have to click on “Retirement” first.)

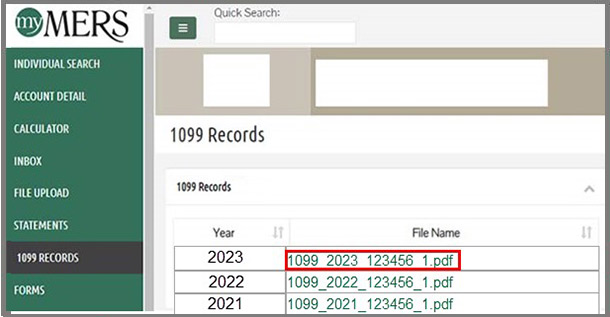

Then from the options on the right side, select “View 1099 Records”.

Under the left side navigation, select “1099 Records”. If you do not see the green column, you will need to hit the green square button with the three horizontal lines.

Finally, select the tax year. The 1099 will open as a PDF file. You can then choose to print or save the file.

Box 1: Gross distribution – The total retirement benefit (both taxable and non-taxable) paid to you for the calendar year, before any deductions.

Box 2a: Taxable amount – The portion of your retirement benefit that is taxable. If you made personal after-tax contributions to your defined benefit plan, this amount should equal Box 1 minus Box 5.

Box 2b: Taxable amount not determined – This box is checked if we were unable to verify the taxable amount because you were already retired when your former employer joined MERS.

Box 4: Federal income tax withheld – The amount of federal income tax withheld from your benefit in 2023.

Box 5: Employee contributions/Designated Roth contributions or insurance premiums – If you made personal after-tax contributions to your defined benefit plan, this box shows the portion of those contributions you are allowed to claim for 2023. This is NOT Designated Roth contributions or insurance premiums.

Box 7: Distribution code(s) – The type of benefit you received. Code descriptions are found on the back of Form 1099-R. Note: Retirees who received a disability retirement payment and have exceeded the normal retirement age for their plan may notice that their code has changed.

Box 9b: Total employee contributions – If 2023 was the first calendar year that you received a retirement benefit payment, this box will show the total amount of personal after-tax contributions you made to your defined benefit plan.

Box 14: State tax withheld – The total of Michigan state tax withheld from your benefit in 2022. MERS only withholds state tax for the state of Michigan.

Account number: Unique number assigned by MERS to distinguish your account.

Hybrid Plan, Defined Contribution Plan, 457 Program and/or IRA

If you withdrew money or rolled assets out of your MERS Defined Contribution Plan (including the defined contribution portion of a Hybrid Plan), 457 Program or IRA during 2023, you will receive a Form 1099-R for each account you took a distribution from. Your 1099-R(s) will be issued by MERS’ recordkeeper, Alerus Retirement and Benefits.

- Forms will be mailed by January 31, 2024, and can be retrieved in your myMERS account once they have been issued.

After logging in to your myMERS account, select “My Documents” at the top of the page.

Then select “View All Tax Forms” from the bottom of the page.

FAQs

1099-Rs are postmarked by January 31 and mailed via first-class to the address that MERS has on file.

If you have set up mail forwarding with the US Postal Service, your 1099-R(s) will be forwarded to you.

If you have a Defined Benefit or Hybrid Plan, your 1099-R will come directly from MERS and is mailed from our Lansing, Michigan office.

If you took a distribution from your Defined Contribution Plan (including the defined contribution portion of a Hybrid Plan), your 1099-R will be issued by Alerus Retirement and Benefits and will be sent from their office in Minnesota.

MI-381957940

MERS is a 401(a) Qualified Public Pension Plan

You will receive one 1099-R for each employer benefit.

If you received some pension benefits before age 59½ and some after age 59½ within the same calendar year, you will receive two 1099-Rs. The difference between the two is the distribution code found in Box 7:

- The one for benefits paid before age 59½ have a “2” in Box 7.

- The one for benefits paid after age 59½ have a “7” in Box 7.

The difference in distribution codes is to comply with IRS coding requirements, and does not affect your withholdings.

The IRS requires that specific distribution codes be used to reflect the type of payments you received from MERS. We have updated the distribution codes we use to comply with those requirements.

- If you collected a disability retirement benefit during 2023, you will receive a 1099R with a distribution code 3.

- If your plan’s definition of normal retirement age allowed you to begin collecting your regular retirement benefit prior to reaching age 59½, you will receive a 1099R form with a distribution code 2.

- Retirement benefit payments made to you after you reached both age 59½ and the normal retirement age defined by your plan will be included on a 1099R form with a distribution code 7.

You will receive one 1099R with the appropriate distribution code for each type of payment you received during the year. For example, if you were collecting a disability retirement benefit, but you reached the normal retirement age defined in your retirement plan during 2023, you would receive two forms, one with a distribution code 3 and one with a distribution code 7.

Retirees and beneficiaries may change their withholding option at any time by submitting a new W-4P to MERS.

A major change to the W-4P form is that filers will no longer be able to adjust their withholding by electing a specific number of withholding allowances. Previously, federal tax withholding calculations for pensions and other eligible periodic payments were based on the filing status (married or single) and number of withholding allowances reported. The revised form has new input fields for increasing or decreasing the amount to withhold, including fields for tax credits and deductions.

While the calculation method is more complex, the IRS maintains that, when completed correctly, the new form will more accurately approximate the amount of tax due at the end of the year.

SUMMARY OF CHANGES FOR IRS FORM W-4P

- You may now select one of the following marital status options:

- Single or Married filing separately

- Married filing jointly or Qualifying widow(er)

- Head of household

- Captures income from multiple jobs/pensions/annuities.

- Claim dependent and other credits.

- Default withholding is now Single with no adjustments (changed from Married with three (3) allowances). Note: If you choose to not have income tax withheld, you may indicate “no withholding” under Step 4(c).See IRS Publication 15-T at irs.gov for more information: https://www.irs.gov/pub/irs-pdf/p15t.pdf

If you need additional assistance in estimating your tax, you should consult with a tax advisor or the IRS. MERS cannot assist you in computing your estimated federal income tax.

Please be advised that, if you elect to have no federal income taxes withheld or if you do not have sufficient federal income tax withheld from your retirement benefits, you may be responsible for payment of estimated tax.